10 percent tax to be increased on gaming and lotteries

The Ministry of Finance has proposed a 10 percent increase in gaming and lotteries tax.

The proposals are contained in the Lotteries and Gaming (Amendment) Bill, 2023 which seeks to amend a number of provisions under the Lotteries and Gaming Act, 2016.

The amendments, signed by Finance Minister Matia Kasaija seeks to increase the tax rate on gaming activities from 20 percent to 30 percent.

ADVERTISEMENT

The Bill is currently under consideration by Parliament, which yesterday invited stakeholders and other interested parties to submit views to the Parliamentary Committee on Finance, Planning and Economic Development.

The Bill, if passed, will have a significant impact on the gaming industry but is expected to generate more revenue. It is expected to take effect on July 1.

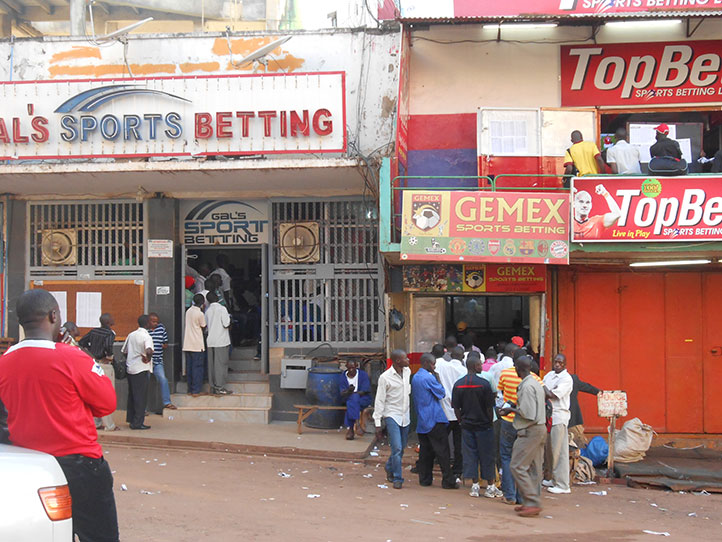

The gaming industry in Uganda has expanded rapidly in recent years, owing in part to the growing popularity of sports betting and online gambling.

According to the Uganda Revenue Authority (URA) annual revenue performance report for the 2021/22 financial year, there was a surplus in tax collected from casinos, which resulted in a significant increase in revenue attributed to gaming tax arrears recovery amounting to Shs35.65b.

This growth resulted in a surplus of Shs22.67b and was caused by compliance enforcement actions that made taxpayers file and make payments, as opposed to prior periods when some taxpayers would only make estimated payments.

URA also indicated that Shs53.68b was collected, increasing by 303.41 percent, the highest percentage increase in tax heads in the last financial year, followed by rental income tax, which increased by 33.15 percent from Shs156.1b. However, some critics argue that the gaming industry has negative social and economic consequences, particularly for vulnerable populations.

Proponents of an increase in game tax argue that the increase will help to mitigate some of the negative effects by providing additional funds for social programmes and initiatives.

However, some stakeholders argue the increment will harm the gaming industry and is likely to discourage investors.

The lotteries and gaming industry is expected to expand further in the coming years, owing to increased access to mobile technology and rising disposable income levels among the country’s population.

![]()